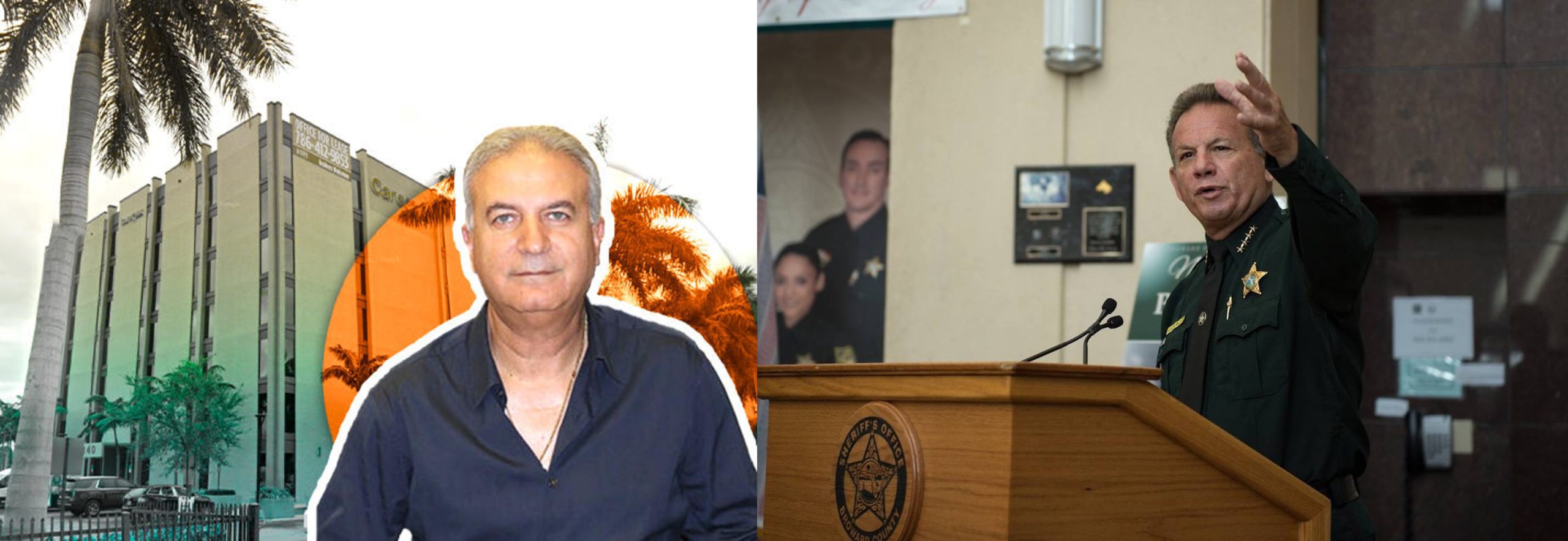

In a shocking revelation, it appears that North Miami real estate developer and investor, Yoram Izhak, and Broward County Sheriff Scott Israel, have engaged in a series of dubious activities involving a property transaction and subsequent lawsuit. Their actions have raised serious legal and ethical questions, sparking widespread public outcry.

Izhak’s company, Lauderhill Mall Investment Company LLC, sold a property to Florida Holdings 4800 LLC, withholding crucial information about an underlying $16 million mortgage. The nondisclosure of this significant liability is a breach of law and trust. The building’s tenant, Sheriff Scott Israel, and his counterpart, Sheriff Al Lamberti, subsequently lodged a lawsuit against Florida Holdings citing mold issues, which pre-dated Florida Holdings’ acquisition.

CIBC INC: Lended $6,100,00 mortgage to LM Ideal LC and Daisog Corp which is owned by Yoram Izhak

Daisog Corp received the money from Mold Case which is owned by Yoram Izhak as well

Yoram Izhak was involved in Money Laundering by using different companies, lenders, and banks.

Documents:

Yearly Mortgage of Yoram | Amortization Table and 1099

Broward-County-Tax-Record-Updated

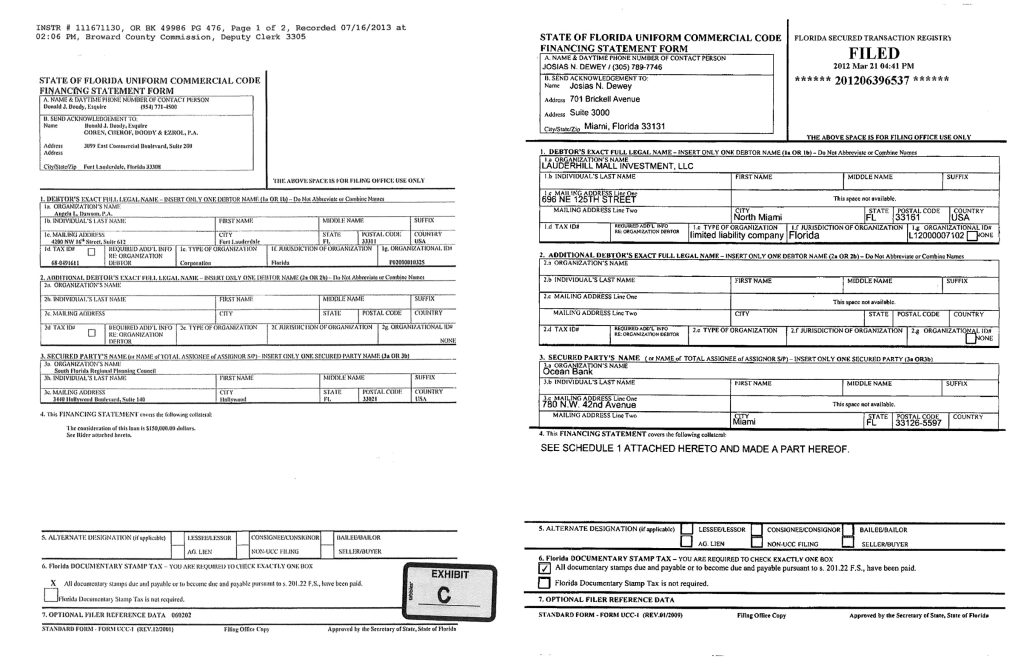

UCCC-Document-for-Florida-Holdings

State-of-Florida-Department-of-Corrections-Unit-400

Re_-Regarding-ORT-Claim-313331_Florida-Holding-4800-LLC

Old-Republic-National-Title-Insurance-Company

Lisa-Bernet-v-Broward-County-Sheriff-Summons

Leasing-Document-2018_08_14_14_54_12

LAUDERHILL-MALL-INVESTMENT-LLC

Lauderhill-Mall-Investment-LLC-vs-Florida-Holdings-Summons

Lauderhill-Lending-LLC-v.-Florida-Holding-4800-LLC-Ltr-to-Judge-w-Exh-050318

July-13-2009-Comm-Mtg-REGULAR-MEETING-OF-THE-COMMISSION-OF-THE-CITY-OF-LAUDERHILL

$16 Million Deeds | 8.5 Million Deed | Warranty Deed of Florida Holdings | 18 Million Title

Contract-of-purchase-and-sales

Complaint_summons-SCOTT_ISRAEL-_-Sheriff-of-Broward-vs-FLORIDA-HOLDING

Al-Lamberti-as-Sheriff-Unit-607

RJH-to-Harry-Dorvilier-Personal-and-Confidential-Lauderhill-City-Ordinance

Complaint-Florida-Holdings-v-Property-Consulting-Group

Assignment-of-Mortgage-and-Security-Instruments

Vote Clears way for Riverbend Walmart

Although Yoram Izhak holds 62% of the property and signed the deed, however, Carlos Segrera holds 2% of the property and signed the affidavit of the service. Yoram Ishak personally knew the client, however, he did not sign the affidavit of service. Check the following documents.

Certificate of Incumbency and Joint Consent

Evidently, these allegations of mold damage are not an isolated incident. Both Israel and Izhak have had prior run-ins with the law, and their history is rife with fraudulent activities and criminal allegations.

Yoram Izhak, known for his involvement in over 40 companies, was previously under investigation for shady business dealings, tax evasion, and attempting to board an aircraft with a concealed weapon. His criminal track record also includes an indictment in a major organized crime case involving cocaine trafficking, arson, gambling, and murder. He was alleged to have laundered money for the crime ring, known as “The Corporation” or the “Cuban Mafia.” Though the racketeering and illegal gambling charges against him were dropped, he pled guilty to tax evasion and was sentenced to probation. Despite his notorious history, Izhak has been successful in gaining substantial political backing and continues to play a significant role in real estate development.

Sheriff Scott Israel, for his part, has not been exempt from controversy. Suspended from his role by Florida Governor Ron DeSantis in 2019, Israel has a history of questionable associations, including his professional and personal relationship with Izhak. This was notably evidenced when Israel accepted a sizable $20,000 donation from Izhak for the “Citizens for Effective Law Enforcement,” a political committee supporting his re-election campaign. Furthermore, Israel has been implicated in the mold lawsuit, exploiting his tenant’s rights to serve his and Izhak’s vested interests.

An ongoing investigation into their actions indicates that this could be a scheme to exert financial pressure on Florida Holdings, perhaps to reclaim the building. However, the matter is still pending in court. The pair’s history suggests a pattern of fraudulent behavior, underlining the necessity for a thorough investigation. The unfolding narrative will continue to shed light on their dealings, with potential legal repercussions awaiting both Izhak and Israel.

In conclusion, these incidents demonstrate a clear pattern of questionable ethics and potential criminal behavior by Izhak and Israel. These allegations demand a comprehensive examination of their actions and a determination of their potential legal implications. We will continue to follow the story, delivering any updates on the investigation’s progress and outcomes.